Winner Announcement

June 10, 2025

Judging Date

May 18, 2026

Registration Opens

August 1, 2025

The Washington State wine industry faces a critical juncture in 2024, grappling with challenges such as harvest setbacks, the Ste. Michelle Wine Estates buyout, and the broader impact of climate change. Despite uncertainties, the industry demonstrates resilience, supported by diversification, strategic leadership transitions, and a commitment to innovation. This article explores the dynamic landscape, emphasizing the collaboration between small and large entities as key to navigating and ensuring a promising future for Washington's diverse wine industry.

The winter of 2024 will represent a turning point for the Washington State wine industry. Nothing speaks to the challenges it faces than a vineyard photo in January’s Good Fruit Grower magazine. The caption reads: “Cabernet sauvignon grapes hang unharvested in late November in the Horse Heaven Hills growing area of Washington.” A few days later the just-released Silicon Valley Bank’s 2024 Wine Industry Report showed the state with 29% lower than average harvest yields in 2023, with just five percent of growers reporting above average yields. An important caveat stated that the “harvest metric” does not even fully represent “the yield produced from planted vines” “because of the number of tons of grapes not picked and the grapes rejected at the scales.” The photo is evidence of that. Good Fruit Grower reported more dire figures: state wineries crushed an estimated 152,000 tons of wine grapes, marking a significant 39% decrease from the state's August projection of 250,000 tons. In Oregon, by contrast, “the harvest was compressed with late heat and average to above-average yields that will all get into the tank.”

It looks a bit scary to be a Washington wine grape grower this winter. The huge contributing factor is easy to pinpoint. In recent decades, Ste. Michelle Wine Estates, known for consistently producing good value wines, faced challenges as it sold a significant portion of its production in pricing bands that fell out of favor, resulting in sluggish sales and too much inventory. That is, lots of lower-priced wines even though they boasted good technical quality. As the Report notes, this caused “an inventory problem in the 2010s, eventually leading to a very large inventory write-off.” In 2021, the company was sold to private equity firm Sycamore Partners, which initiated changes. From New York City in August 2023, Sycamore informed Washington growers of a 40% reduction in purchase agreements, impacting approximately 15% of the state's total wine production.

Buyouts and consolidation will continue to have serious impacts on winegrowers.

Many of Washington's wine grape growers felt the effect of these volume reductions last year. The takeaway is that dependence on one huge corporate wine producer, like Ste. Michelle, combined with the trend towards private equity buyouts, can have serious economic effects that will reverberate through the state. Sycamore is known for acquiring and investing in distressed or undervalued retail brands, aiming to improve their performance and profitability. Perhaps if Ste. Michelle had paid greater attention to market trends, and market differentiation, and hewed more towards premium bottlings or acquisitions in the 2010s, it would have escaped the buyout.

Source: Washington Wine

Washington’s industry, however, is diversified, producing 80+ varieties, the Washington State Wine Commission is responding, and the state has tremendous resources, including top-notch research capacity at Washington State University. Washington’s wine industry allocates 25% of its budget to support the viticulture and enology research program, along with the state-of-the-art WSU Wine Science Center. Ninety percent of Washington state’s wineries are small, family-owned businesses that make fewer than 5,000 cases a year, a percentage even greater than that for Oregon. However, Washington remains the second largest wine producer in the US. These facts perhaps point to the overall industry imbalance that will need addressing. In addition, as expert Elin McCoy recently observed on The Wine Conversation, another issue is that Washington appears to never have developed a reputation for a leading wine style, such as Napa Cabernet or Oregon Pinot Noir. Washington State Merlot has that potential, as do Bordeaux blends. This will depend on the quality of small producers and their marketing prowess.

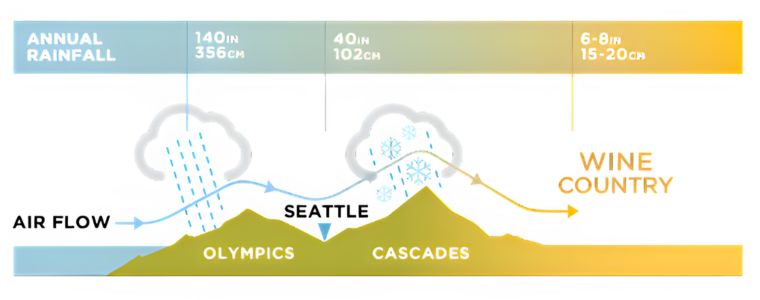

Image: Washington has unique natural attributes for quality winegrowing; Source: Washington Wine

The Washington Wine Industry Foundation also plays a role, and, not surprisingly given the challenging times, has appointed a new chief executive. Effective January 1, Sara Higgins took on the role of Executive Director, bringing over 20 years of non-profit leadership experience with a focus on planning, program management, and community outreach. Board Chair Bill Shibley expresses confidence in Higgins, citing her energy, drive, and familiarity with the wine industry as an excellent match for the Foundation's needs. As a Washington native, Higgins has previously supported Foundation programs and will now be responsible for implementing the Board's strategic plan, fostering donor relations, and continuing the Foundation's impactful work, which includes awarding over $3 million in grants supporting winemaking and wine grape growing since 2002, as well as providing $480,000 in scholarships to over 250 viticulture and enology students. Vicky Scharlau, the outgoing Executive Director, will continue in an of-counsel position, supporting federal and state grant management, and praised Higgins as the right person to address new challenges in the evolving industry landscape.

The unexpected low crush in 2023 has led some growers to face challenges in selling their grapes, resulting in creative measures such as removing vines and exploring new product opportunities. As Good Fruit reports, industry experts like Erik McLaughlin of METIS believe that Washington's wine industry, with its mix of large companies and boutique wineries, can still succeed by focusing on the 20- to 50-dollar range. Rebecca De Kleine of Four Feathers Wine Services sees opportunities for new products and packages, and some growers view the Ste. Michelle's situation is a "forced opportunity" to replace less productive blocks with different varieties. The industry is expected to navigate these changes by tapping into creativity, expertise, and a willingness to take risks.

Indeed, before Sycamore’s shocking announcement, substantial optimism existed among winegrowers. In 2022, Washington State saw the establishment of 20 new wineries, adding to the state's total of 1,070 licensed wineries, second only to California. Kristina Kelley, the executive director of the Washington State Wine Commission, emphasized the state's competitive advantage, stating, "Some wine regions really only specialize in a handful of wines, and I think for a consumer they can find anything they may like here in Washington state." Reed Woogerd, director of operations for Valdemar Estates, has transformed their taproom into a Tapas restaurant named Pintxo, highlighting their commitment to the industry's health and attention. Both direct-to-consumer and on-trade sales will be of utmost importance to winegrowers as we move into 2024 and beyond.

Indeed, Kelley acknowledged challenges, including attracting younger consumers amidst the ready-to-drink cocktail trend, noting, "The ready-to-drink cocktail phenomena is here." She also highlighted climate change as a significant challenge, with wildfires threatening the industry as extreme climate events become more common. Researchers at Washington State University are leading studies on the effects of wildfire smoke on vineyards. The National Interagency Fire Center's July 1, 2023, forecast revealed an elevated risk for wildfires across most of Washington state and Oregon. As climate change contributes to larger, more frequent wildfires in the West, the wine industry is adapting to protect vineyards. Winemakers are altering production methods, seeking increased access to crop insurance, and urging controlled burns to mitigate wildfire risks. Smoke taint, caused by volatile phenols in smoke, poses a significant challenge, with its impact often detected years after bottling. To address this, the recently introduced Smoke Exposure Research Act aims to identify compounds responsible for smoke taint, establish screening tools, and study potential barriers between wine grapes and smoke compounds.

[[relatedPurchasesItems-61]]

Overall, the industry is driven by efforts to preserve the diverse flavors of red and white wines across the region. The question is, will diversity and 90% small wine producers be enough? Given the state’s strength in quality production, top-notch terroirs, industry- and government-backing, and serious research capacity, it should be.

In conclusion, the Washington State wine industry faces a critical juncture in 2024, navigating challenges brought on by changing corporate strategies, economic shifts, and the escalating impact of climate change. While uncertainties persist, the resilience and adaptability of growers and industry stakeholders shine through. The state's commitment to diversity, innovation, and research, coupled with strategic leadership transitions, positions Washington to overcome obstacles and continue producing exceptional wines. As the industry evolves, the collaboration between small, family-owned businesses and larger entities will likely define the path forward, ensuring a dynamic and promising future for Washington's diverse and thriving wine landscape.

Note: Header Image - Washington State vineyard in December 2023; Source: Ross Courtney/Good Fruit Grower

Enter your Wines now and get in front of top Sommeliers, Wine Directors, and On-Premise Wine Buyers of USA.